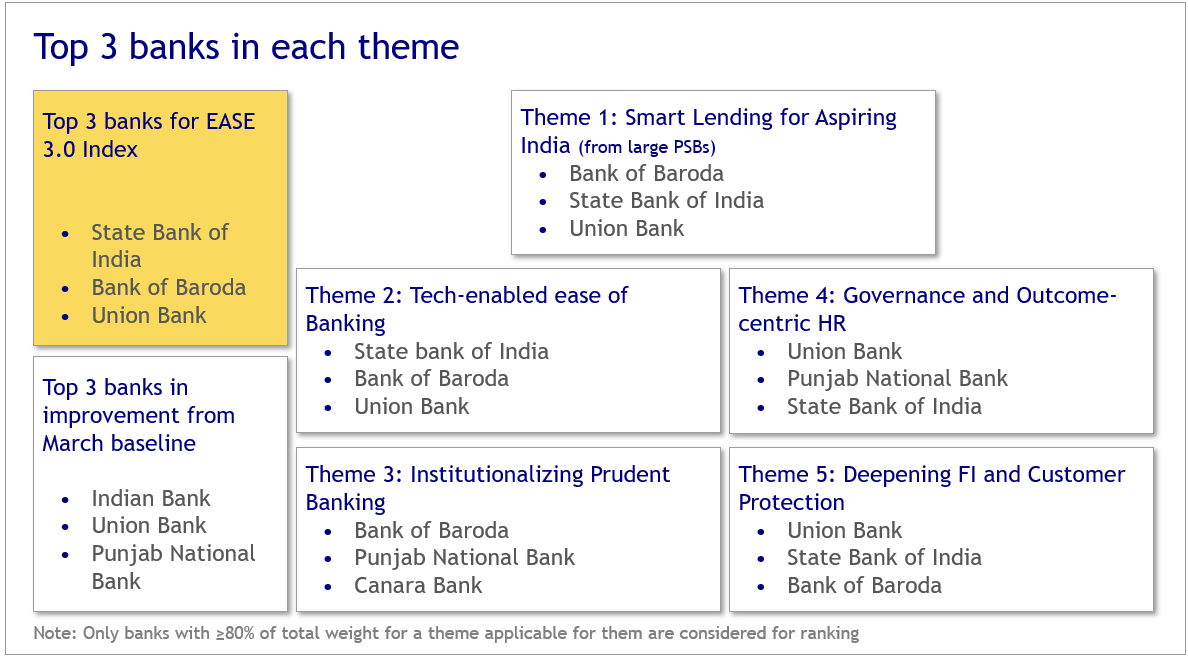

Shri Pankaj Jain, Additional Secretary, Department of Financial Services, Shri Amit Agrawal, Additional Secretary, Department of Financial Services & Chairman IBA, Shri Rajkiran Rai G., were also present at the event. State Bank of India, Bank of Baroda and Union Bank of India have won the awards for best performing banks for PSB Reforms EASE 3.0 based on the EASE index.

.1 Canara Bank

• Second runner-up in the Institutionalising Prudent Banking

theme

• MD & CEO – Mr LV Prabhakar

• Integration of IT-based risk-scoring and categorization system

with key internal IT systems such as CBS, loan management system and internal

credit rating system

• Accelerated recovery on e-auctioning platforms with 100% of

assets eligible for recovery listed on such platforms as of Mar'21

1.2 Punjab National Bank

• Runners-up in two theme-wise awards –

o Governance & Outcome centric HR;

o Institutionalizing Prudent Banking

• Second runner-up in the best improvement category

o 42% improvement over baseline

• MD & CEO – Mr CH.S.S. Mallikarjuna Rao

• 100% coverage of loans, including retail and small ticket MSME

customers in EWS

• 95% officers in key business impacting roles with very high

measurability levels

• Robust Succession planning for the key roles and IDP creation

for potential successors

1.3 Indian Bank

• Winner in the best improvement category

o 56% improvement over baseline

• MD & CEO – Smt. Padmaja Chunduru

• Completed setup of capabilities across people, processes and

systems to drive end-to-end digitization of retail and MSME loans, such as

tie-ups with fintechs covering 8 key use-cases

• Rolled-out analytics-based models for customer-need driven

proactive credit offers

• Instituted key collections capabilities such as dedicated

collections officers and tie-ups with call centers to drive focused efforts

•

Activated all five digital channels during the year for

origination of loan requests from retail and MSME customers

1.4 Union Bank of India

• Winner in theme-wise awards

o Governance & outcome-centric HR

o Deepening Financial inclusion & customer protection

• Second runner-up in theme-wise awards

o Smart lending

o tech-enabled ease of banking themes

• First runner-up in best improvement category

o 47% improvement over the baseline

• Second runner-up for the EASE Reforms Index Award 2021

• MD & CEO – Mr. Rajkiran Rai G.

• Implemented a scientific and digitalised Performance Management

System with high APAR measurability levels for more than 95% of Bank officers

• Set up of IT-based HR Deployment Decision Support System with

best in class features and functionalities for postings and transfers

• Best bank on EASE cyber-security maturity framework

• First Public sector bank to implement end-to-end digitalisation

of MSME credit limit renewals with approximately ₹3,000 crore of MSME

loans processed in a straight through manner in FY’21

• >70% long-term agri loans processed via loan management

system

1.5 Bank of Baroda

• Winner in theme-wise awards

o Smart Lending,

o Institutionalizing Prudent Banking themes

• First Runner up in theme-wise awards o Tech-enabled ease of

banking

• Second runner-up

o Deepening Financial Inclusion and Customer Protection

• First runner-up for the EASE Reforms Index Award 2021

• MD & CEO - Mr. Sanjiv Chadha

• End-to-end digitalization of credit delivery to retail customers

with more than 1,20,000 personal loans sanctioned instantaneously in H2 FY’21

•

End-to-end digitalization of credit delivery to MSME customers

with more than 1,15,000 Shishu Mudra loans sanctioned in less than 3 days in H2

FY’21

• 60% loans sanctioned using analytics on existing customer data,

partnerships and dedicated marketing officers

• More than 95% loans covered through EWS

• Best-in-class adoption of digital channels with approximately

80% financial transactions undertaken through such channels

• Best-in-class enrolment rate for PM Schemes for life insurance

and personal accident insurance

1.6 State Bank of India

• Winner in theme-wise awards

o Tech-enabled Ease of banking

• First runner-up

o Smart Lending

o Deepening Financial Inclusion and Customer Protection themes

• Second runner-up

o Governance and Outcome-centric HR

• Overall winner of the EASE Reforms Index Award 2021

• Chairman - Mr. Dinesh K Khara

• At-scale end-to-end digitization of retail credit with more than

₹24,000 crore of

personal loans sanctioned instantaneously, leveraging partnerships with FinTech

players

• More than ₹34,000 crores of retail

loans originated through digital channels such as SMS, missed call, call

center, mobile banking and internet banking platforms

• Pioneered centralized tracking of waiting time and transaction

time covering more than 65% transaction-intensive metro and urban branches for

improved customer experience

• Best-in-class service offerings on mobile app, with highest

adoption rate across credit and non-credit products

• Instituted design of specialized career paths covering

approximately 75,000 employees of the Bank under Job Family initiative

• Implemented a scientific and digitalised Performance Management

System with more than 85% of APAR scores getting auto populated from Bank's IT

systems

• More than 6.5 crore eligible customers enrolled under micro life

insurance and micro personal accident insurance schemes

Public Sector Banks have reported healthy profits and have accelerated on technology-driven reforms. These banks have reported a profit of Rs. 31,817 crore in FY21 as compared to a loss of Rs. 26,016 crore in FY20. This is the first year when PSBs have reported profit after five years of losses. Total gross non-performing assets stood at Rs. 6.16 lakh crore as of March 2021 - a reduction of Rs. 62,000 crore from March 2020 levels.

Digital lending

·

Credit@click was a flagship

initiative under EASE 3.0. Nearly 4.4 lakh customers have been

benefitted through such instantaneous and simplified credit access.

·

PSBs have setup mechanism for

customers where they can register loan requests 24X7 through digital channels such as Mobile and Internet

banking, SMS, missed call and call centre. In FY21, PSBs have collectively

disbursed Rs. 40,819 crore of fresh personal, home and

vehicle loans through leads sourced from such digital channels.

·

The top 7 PSBs have built analytics

capabilities through the setup of dedicated analytics teams and IT

infrastructure to proactively offer loans to its existing customers. Such loan

offers were generated using the existing customer transactions data within the

banks. In FY21, Rs. 49,777 crore of fresh retail loan

disbursements were made by the top 7 PSBs based on these credit offers.

·

PSBs have also extensively used

external partnerships and dedicated marketing salesforce network for the

sourcing of retail segment and MSME segment loans. Sourcing from such channels

has been 9.1 lakh loans in FY21.

Mobile/Internet banking and customer service

·

Nearly 72% of financial

transactions happening at PSBs is now happening through digital

channels. PSBs are now offering services across call centres,

Internet banking, and Mobile banking in 14 regional languages such

as Telugu, Marathi, Kannada, Tamil, Malayalam, Gujarati, Bengali, Odia,

Kashmiri, Konkani, Hindi, Punjabi, Assamese for the ease of customers.

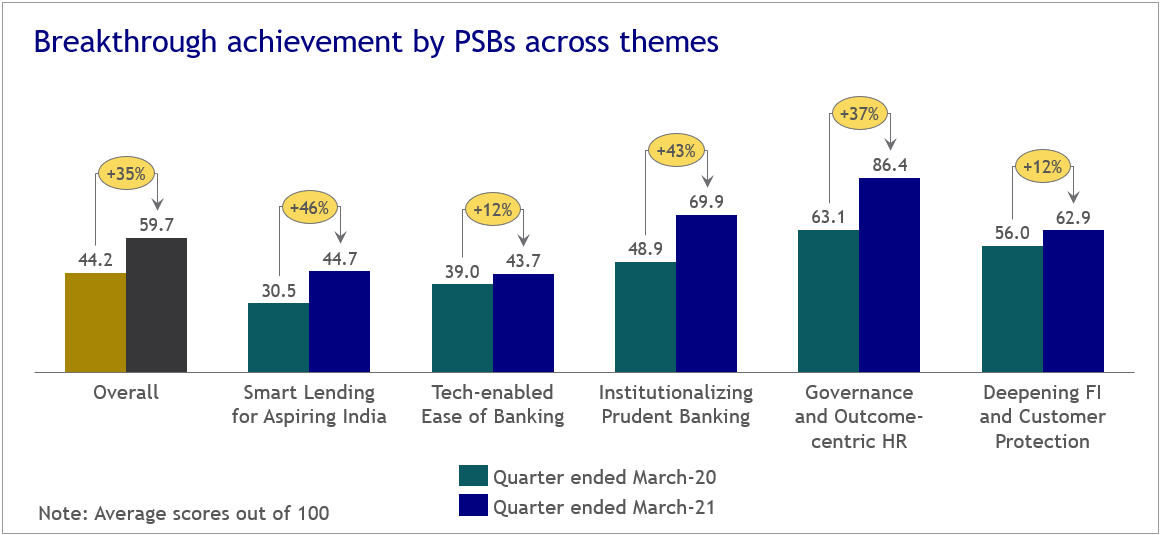

PSBs have recorded a phenomenal growth in their

performance over four quarters since the launch of EASE 3.0 Reforms Agenda. The

overall score of PSBs increased by 35% between March-2020 and March-2021, with

the average EASE index score improving from 44.2 to 59.7 out of 100.

Significant progress is seen across six themes of the Reforms Agenda, with the

highest improvement seen in the themes of ‘Smart Lending’ and

‘Institutionalising Prudent Banking’.

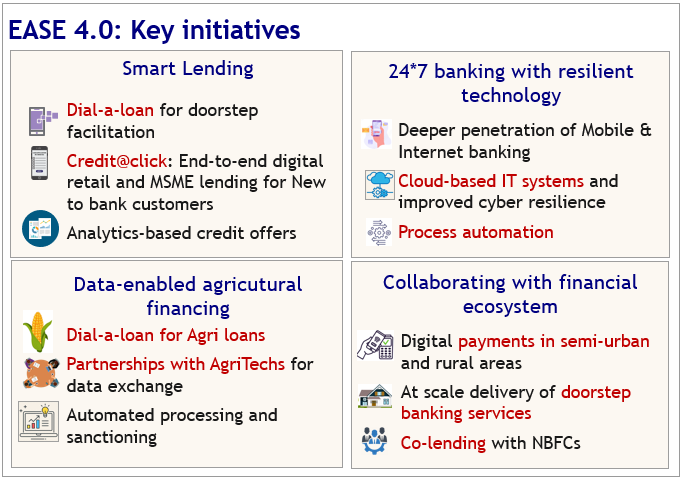

What is EASE 4.0?

EASE 4.0 – Tech-enabled, simplified, and collaborative banking

The next edition of EASE reforms

i.e. EASE 4.0 aims to further the agenda of customer-centric digital

transformation and deeply embed digital and data into PSBs' ways of working.

EASE 4.0 is a common reform agenda for Public Sector Banks (PSBs)

aimed at institutionalizing clean and smart banking.

Key Features of EASE 4.0

-

Data enabled agricultural credit : Dial a loan for Agri loans -

Smart Lending: Credit@click ; Dial-a-loan |

EASE has become the cornerstone of reforms in PSBs. The

institution of the comprehensive index has catalysed accelerated implementation

of several initiatives and has injected greater customer centricity in PSBs’

business model and processes. PSBs have fundamentally re-oriented their ways of

working to align with EASE methodology and have made concerted efforts to

deep-root reforms and maximise the value derived from them.

The next edition of EASE reforms i.e., EASE 4.0 aims to further

the agenda of customer-centric digital transformation and deeply embed digital

and data into PSBs’ ways of working. Two new themes have been

introduced to deliver on these objectives.

New Age 24x7

banking with resilient technology has been introduced to ensure uninterrupted

availability of banking services by ensuring

24X7 availability of select banking

channels, improving the reliability

of technology platforms, and aligning internal

processes in the PSBs to deliver such services.

Collaborative

banking for synergistic outcomes aims to

maximise synergies through collaboration between PSBs and with broader

financial services ecosystem such as NBFCs for the coordinated handling of

co-originated loans.

In addition to the above new themes, several other new reforms

will be added to existing themes such as increased use of digital and data for

Agri financing through partnerships with third parties for alternate data

exchange, driving impetus on digital payments in semi-urban and rural areas,

at-scale adoption of doorstep banking services for PSB customers, etc.

With the amalgamation of 13 PSBs into 5 PSBs now successfully complete, EASE 4.0 sets the agenda and roadmap to transform all PSBs into digital-attacker banks working hand-in-hand with key constituents of the financial services ecosystem to offer industry-best customer experience.

RECAP

OF EASE REFORMS: EASE1.0; EASE 2.0 AND EASE 3.0 – The Journey of PSB Reforms

EASE Agenda

What is EASE ?

PSB reforms agenda – EASE (Enhanced Access and Service Excellence) was launched based on the recommendations made by PSB Whole Time Directors (WTDs) and senior executives in PSB Manthan in November 2017. It encapsulates a synergistic approach to ensure prudent and clean lending, better customer service, simplified and enhanced credit, and robust governance and HR practices. The Reforms Agenda is pursued through a unique Reforms Index that enabled objective assessment of progress on all key areas in PSBs — viz., governance, prudential lending, risk management, technology- and data-driven banking, and outcome-centric HR — as well as enhanced transparency and accountability in the wider financial ecosystem.

EASE Reforms Agenda:

1.

It was launched in January 2018 jointly by the

government and PSBs.

2.

It was commissioned through Indian Banks’ Association

and authored by Boston Consulting Group.

3.

EASE Agenda is aimed at institutionalizing CLEAN and

SMART banking.

4.

The Index measures performance of each PSB on 120+ objective

metrics

EASE 1.0:

The EASE 1.0 report showed significant improvement in PSB

performance in resolution of Non-Performing Assets (NPAs) transparently.

The first edition of the EASE program pertaining to FY19 aimed

at laying the foundation for themes such as Customer Responsiveness by enabling

banking from the comfort of home and mobile and grievance redressal,

responsible banking through the setup of dedicated Stressed Assets Management

Vertical (SAMV) for rigorous monitoring of large-value stressed loans, improved

governance and financial stability through institutionalising risk appetite

frameworks and riskbased pricing, near-home banking by providing branch

equivalent services through Bank Mitras, and enhanced micro-insurance coverage

ensuring financial inclusion, and developing personnel for Brand PSBs through

initiatives such as the implementation of Performance Management System (PMS).

( Please click on the

following link for detailed read on: Enhanced Access & Service Excellence (EASE) Reforms

for Public Sector Banks

http://rakeshkhareblogs.blogspot.com/2020/03/enhanced-access-service-excellence-ease.html

)

EASE 2.0:

EASE 2.0 builds on the foundation of EASE

1.0 and introduces new reform Action Points across six themes to make reforms

journey irreversible, strengthen processes and systems, and drive outcomes.

The six themes of EASE are:

1.

Responsible

Banking.

2.

Customer

Responsiveness.

3.

Credit

Off-take.

4.

PSBs

as UdyamiMitra (SIDBI portal for credit management of MSMEs).

5.

Financial

Inclusion & Digitalisation.

6.

Governance

and HR.

EASE Reforms Index:

·

The

Index measures performance of each PSB on 120+ objective

metrics.

·

The

Index follows a fully transparent scoring methodology, which enables

banks to identify their strengths as well as areas for

improvement.

·

The

goal is to continue driving change by encouraging healthy competition

among PSBs.

The second edition of the

EASE program for CLEAN and SMART banking was launched for FY20 to further build

on the foundation of EASE 1.0. It has been instrumental in further

systematically addressing root causes of weaknesses in PSBs effected through

hard-wiring of sound IT systems and processes. It has set up comprehensive Loan

Management Systems (LMS) for faster processing and tracking, introduced Early

Warning Signals (EWS) systems and specialised monitoring for timebound action

in respect of stress, put in place focussed recovery arrangements, and

esablished outcome-centric HR systems. The reforms have equipped Boards and

leadership for effective governance. Further, it has enabled banking from home

and mobile through an expanded bouquet of services, including enhanced regional

languages availability.

( Please click on the

following link for detailed read on: EASE 2.0 Banking Reforms Index - Performance of Public

Sector Banks from March 2018-2020. http://rakeshkhareblogs.blogspot.com/2020/09/ease-20-banking-reforms-index.html#more)

EASE 3.0 — Smart, Tech-enabled Banking

for Aspiring India

Key Reform Action Points in EASE 3.0 include:

- Dial-a-loan: Digitally-enabled doorstep facilitation for initiation of

retail and MSME loans. Customers will have the facility to register loan

requests through digitally-enabled channels

- Customer-need driven credit offers by larger PSBs to existing

customers through analytics, e.g., for EMI on expenses like

holidays/school-fees/jewellery/consumer durables, home loan takeovers,

loan-against-property post home loan closure, working capital enhancement

based on sales jump

- Partnerships with FinTechs and E-commerce companies for customer-need driven credit

offers

- Credit@click: End-to-end digitalised, time-bound retail and MSME lending by

larger PSBs, leveraging Account Aggregators, FinTechs and

PSBloansin59minutes.com

- Cash-flow-based MSME credit by larger PSBs, using FinTech, Account Aggregator and other

third-party data and transactions-based underwriting models

- Tech-enabled agriculture lending

- Palm banking: End-to-end digitalised delivery of a full bouquet of financial

services in regional languages and with industry-best service quality

EASE

Banking Outlets:

On-the-spot banking at frequently visited places such as train stations, bus

stands, malls, hospitals, etc. through paperless and digitally-enabled banking

outlets and kiosks.

The third edition of the EASE reforms (EASE 3.0) was launched in

FY21 to help catalyse accelerated adoption of customer-centric digital

transformation initiatives across PSBs.

( Please click on the following link for

detailed read on: Finance Minister unveils EASE Roadmap for Banking of the Future

EASE 3.0 Reforms : https://yourcareerheights.com/?p=4116)

Source:

https://pib.gov.in/PressReleasePage.aspx?PRID=1748922; http://164.100.117.97/WriteReadData/userfiles/EASE%20awards_for%20PIB%20(1).pdf

http://164.100.117.97/WriteReadData/userfiles/EASE%204.0.pdf

http://rakeshkhareblogs.blogspot.com

& https://yourcareerheights.com/?p=4116