The Government of India announces details of Bank recap and

Comprehensive Reform Plan

In order to improve the

performance & image of PSBs, Govt has introduced EASE in a time

bound manner. Infusion of capital depended exclusively on the extent of

implementation of these reforms agenda in banks. It is therefore imperative

for banks to implement these reforms agenda unfailingly.

On 24th January 2018

the Government of India unveiled details of the re-capitalisation of

Public Sector Banks (PSBs) announced in October, 2017. The capital

infusion plan for 2017-18 included Rs.80,000 crore through Recap Bonds and

Rs.8,139 crore as budgetary support. This plan addressed regulatory

capital requirement of all PSBs and provides a significant amount towards

growth capital for increasing lending to the economy.

The six key

groups have provided suggestions for responsible and responsive banking,

enhanced credit offtake, MSME lending, deepening financial inclusion, and NPA

resolution. The Reserve Bank of India has

said in its Financial Stability Report (FSR) that the gross NPA ratio of all

scheduled Commercial Banks (SCBs) may increase from 9.6% in March 2017 to 10.2%

by March 2018.

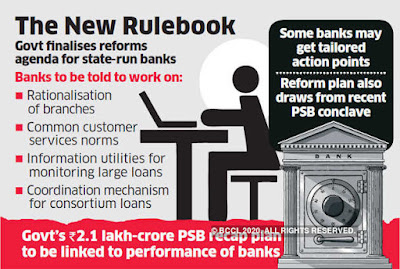

The Central Government was

of the view that it cannot go on infusing capital in state-run banks while

lenders continue to function the way they have. The recap was to be accompanied

by a strong reforms package across six themes incorporating 30

action points.

The reforms agenda was based on

the recommendations made at the PSB Manthan held in November, 2017 involving

senior management of PSBs and representatives from Government.

The reform agenda was aimed at EASE

- Enhanced Access and Service Excellence, which was focussed on six

themes as under:

- Customer responsiveness,

- Responsible banking,

- Credit off take,

- PSBs as Udyami Mitra,

- Deepening financial inclusion & Digitalisation and

- Developing personnel for brand PSB.

- Responsible banking,

- Credit off take,

- PSBs as Udyami Mitra,

- Deepening financial inclusion & Digitalisation and

- Developing personnel for brand PSB.

The

overarching framework for the reforms agenda is “Responsive and

Responsible PSBs”.

Capital

infusion by the Government was contingent on performance of PSBs on the

reform. Whole Time Directors of PSBs would be assigned theme wise reforms

for implementation. Their performance in this regard would be evaluated

by the bank Board.

A survey by an

independent agency in respect of EASE would be conducted to measure public

perception about improvements in access and service quality. Results of

the survey shall be made public each year.

The recap & reform

agenda was sharply focused on strengthening PSBs, increasing lending to

MSMEs and making it easier for MSMEs and retail customers to transact as well

as significantly increasing access to banking services. It includes a

commitment to banking services within 5 kms of every village, refund within 10

days of any unauthorised debit in electronic transactions, a mobile App

for locating banking outlets and a mobile ATM in every underserved

district.

(Source: https://pib.gov.in/newsite/PrintRelease.aspx?relid=175850

& Economic Times :https://economictimes.indiatimes.com/industry/banking/finance/banking/govt-ties-recapitalisation-of-public-sector-banks-to-action-on-reforms-agenda/articleshow/62329300.cms)

Following is the EASE Reforms Agenda as announced by the Government to be complied with:

The 30 action points have to be necessarily

implemented by banks without any exception. All staff members should

be aware of these reform agendas. Based on the extent of implementation of

these action points, banks would be rated. Proper implementation of

these action points would get the Banks good ranking. Hence Banks should

endeavour to get good rating. An external agency, BCG had been appointed for

the purpose by IBA.

ACTION POINTS FOR BANKING

REFORMS

CUSTOMER

RESPONSIVENESS

AP- 1. EASE for customer

comfort:

1. Banking from home and

mobile to

progressively make brick-and-mortar branch visits redundant:

Promote digital banking, such as Internet banking, mobile

banking, integrated mobile apps and phone banking for EASE of opening accounts and fixed deposits,

nomination, sanction of overdraft facility, online loan application,

e-payments, return preparation, etc.

2. Simplification of forms:

(a) Maximum

two pages for KYC, and two pages for account-opening (inclusive of nomination,

Form 60/61, and all other services)

(b) Online

forms with auto-filling of information already held by bank, and likely default

entries (e.g., current address same as permanent

address)

3. Suite of financial

services for one-stop access to customers, including banking-plus services such as insurance and

investment:

(a) Board-approved plan

(b) Implementation, with partnerships and

skilling of personnel

4. Pleasing ambience of

customer service area, with proper

seating, uncluttered urroundings, cleanliness, proper whitewashing and

painting, etc.

5. Courteous & smartly

attired staff:

Bank-approved code of customer interface

6. Basic customer amenities :

Customer access to clean toilets and safe drinking water.

7. Uniform and attractive

signage for customer assistance in languages as per RBI’s instructions

AP- 2. in grievance redressal

:

8. System-driven grievance

redressal mechanism with—

(a) real-time complaint status tracking by

complainant;

(b) time-bound auto-escalation, compliant

with time limits laid down by RBI;

(c) feedback from complainant to check the

quality of redressal; and

(d) root cause analysis and effective

action on common grievances to avoid recurrence

AP- 3.EASE for senior

citizens and the differently abled:

9. Doorstep banking

10. Preference in service, or dedicated

counters

11. Free cheque-book issuance, without visit

12. Online update of pension life certificate

13. Automatic benefits of senior citizens

accounts

14. Visually handicapped may withdraw through

authorised person

15. Providing TDS exemption forms proactively

AP- 4. Introduction of EASE

Rankings on customer EASE:

16. Annual EASE Ranking survey to measure banks’ customer-responsiveness,

assessed on all items, through customer survey and objective measurement

EASE Ranking Index to be to be published annually.

RESPONSIVE BANKING

AP-5. Creation of a Stressed

Asset Management Vertical (SAMV):

17. (a) For focussed recovery efforts through a

dedicated, specialised and motivated team for enhanced and timely recovery,

under a Board approved policy delineating its scope, roles and responsibilities

(b)

Appropriate staffing, with incentive structure linked directly to benchmarked

enhancements in recovery levels

(c) Migration

of identified Stressed Assets and high-value Special Mention Accounts (SMAs) to

SAMV

AP-6. Clean corporate lending

through rigorous due diligence and appraisal for sanction:

(a) Ensure

that necessary regulatory clearances/approvals are in place, and appropriate

backward and forward linkages are tied up before disbursement

(b)

Scrutinise group balance-sheet and ring-fencing of cash flows

(c) Consider

non-fund and tail risk embedded in project financing

(d) Initiate

process for use of technology and analytics for comprehensive due diligence

across data sources

(e) Lead

banks in consortium to build capacity for techno-economic valuation, and their

consortium banks to build requisite capacity to validate/assess such valuation

AP-7. Tie-up with Agencies

for Specialised Monitoring (ASMs) for clean and effective post-sanction follow-up, on common engagement basis in case of

consortium lending, for :

19. (a) aspects

requiring domain expertise (e.g., inspection and stock audit); and

(b) large

credit exposures (say, above Rs. 250 crore) and exposures of a specialised

nature.

AP-8. Institute efficient

practices for effective coordination in large consortium loans:

20. Observe a minimum threshold for

participating in consortium loans (say,10% )

21. Adopt an SOP for the valuation process in

consortium loans to synchronise date, periodicity and methodology of valuation,

supported by online mechanism for sharing among consortium members

22. Model SOP for coordination among Joint

Lenders’ Forum (JLF) members

AP-9. Strict segregation of

pre- and post-sanction roles & responsibilities & for enhanced accountability:

23.

(a)

Board-approved policy for strict segregation of roles and assignment of

responsibilities for appraisal, monitoring and recovery

(b) Identification, training and placement

of staff

AP-10. Differentiated Banking

Strategy (DBS) thr ough smaller banks & to leverage their competitive advantage for strong

regional and market segment connect, covering Board-approved:

24. (a) business

plan, including asset swap/sale plan to achieve desired risk weighted asset

mix, with limited corporate exposure (about 25% of total risk weighted assets)

and initial reduction of corporate exposure share by Mar 2019 to below 40% or

by at least 15% from Sep 2017 level;

(b) branch network rationalisation plan;

and

(c) plan

for realigning organisational resources (including HR, IT and partnerships).

Illustrative

categorisation:

• National retail banks,

&

• Regional retail banks

AP-11. EASE through

transparent and robust One-Time Settlement & (OTS)mechanism, for timely and better realisation through

an online OTS platform

25 (a) End-to-end processing, till repayment or

recovery in case of nonadherence to OTS; and

(b) Automated escalation and

monitoring.

Furthering Financial Stability

AP-12. Check aggressive and

imprudent lending through proactive, dynamic & systemic risk management :

26. Institute and implement Risk Appetite Framework for a structured approach to manage,

measure and control risk, with following features:

(a) Cover

policies, processes, controls and systems for both material and reputational

risks

(b) Include a

risk appetite statement, risk limits, and outline of roles and responsibilities

of those overseeing implementation and monitoring

27. Institute and implement Risk Based Pricing for pricing loans, keeping in view

risk-adjusted return

28. Appointment of Chief Risk

Officer with requisite skills, having direct reporting lines to the MD & CEO /

Risk Management Committee of the Board

29. Stress-testing to be

carried out semi-annually, as per RBI’s Stress Testing Guidelines, for eight quarters, and report of

the results to be presented to the Board, with particular attention to:

(a) concentration exposures at the

borrower, group and sector levels, and

(b) contingency plans under the stress-test

scenarios.

AP-13. Monetise realisable

value from sale of non-core assets to strengthen the bank and focus on core business, as per

asset-wise, time-bound Board-approved plan for:

30. (a)

Exit from all ‘s trategic equity investment’ in unrelated businesses and sale

of all real estate not used for bank operations; and

(b)

Divestment of stake for optimal realisation of value in viable complementary

businesses.

AP-14. Rationalise overseas

operations with in and

across PSBs for cost efficiencies and synergies in overseas markets:

31. (a)

Based on competitive strength and viability

(b) Draw up

Business-Unit-wise Board-approved plan, for time-boundclosure/ consolidation as

per due procedure, to:

(i) Close non-viable branches;

(ii)

Consolidate operations in the same geography, taking into account operations of

other PSBs; and

(iii) Consolidate equity stake in joint

venture having multiple PSB partners.

Ensuring Outcomes – Governance

AP-15. Board-approved

strategic vision and business focus plan for five years , consistent with its Risk Appetite

Framework and, where applicable,

30 Differentiated Banking Strategy

AP-16.Boards to evaluate

performance of Banks’ Whole Time Directors

31. reporting to the bank chief executive on

implementation of the Reforms Agenda

CREDIT

OFF-TAKE

AP-17. EASE for the borrower:

32. Online application

facility for home, education, vehicle and other personal loans, with 100%

processing on automated basis, for timebound decision-making and transparent

status-tracking

33. Digitalise non-retail

credit appraisal process on end-to-end basis

34. Step up cash-flow

financing substantially

35. Rationalise

decision-making layers: maximum three layers

AP-18. Proactive reach-out to

borrowers:

36. Dedicated feet-on-street — as against reliance on branch-based

reach-in

37. Broad-base bank’s

business-connect:

(i) Institute credit-plus

services for

handholding borrowers for improved access to finance as a result of enhanced

bankability of proposals

(ii)

Reach-out to entrepreneurs, in association with chambers of commerce and

industry associations

AP-19. Strategy plans for key

industry-based market segments:

38. Board-approved plans for key industry-based

market segments:

(a) Differentiated products and services

(b) Development of industry-wise technical

expertise

PSBs AS UdyamiMitra FOR MSMEs

AP-20. EASE of bill realisation for

MSMEs:

39. Registration of all banks

on TReDS platform for

faster bill discounting

AP-21. EASE of financing for MSMEs:

40. Board-approved policy for

enhanced working capital to GSTregistered MSMEs, and its roll-out

41. Enable MSME financing

through cluster-based financing and FinTech:

(a) Substantially step up cluster-based

lending

(b)Improve

due diligence, better risk assessment and faster turnaround through FinTech

(financial technology innovation for business transaction)

42. Time-bound and automated

processing of MSME loan proposals, including—

(a) 15-day decision timeframe for proposals

on www.udyamimitra.com, and

(b) online application facility and

automated decision for all micro-enterprise

Loans

AP-22. Single-point MSME

Relationship Officers:

43. Designated single-point MSME Relationship

Officers for the top-20 MSME

accounts in every MSME-Specialised Branch (total 3,319

branches across

PSBs)

AP-23. Revival Framework for

stressed MSMEs:

44. Identification of all SMA-1/2 MSME accounts

needing help through the Revival Framework in every MSME-Specialised Branch

45. At least two meetings of the Framework

Committee to be held by Mar 2018 to take up all identified cases

Deepening Financial Inclusion &

Digitalisation

AP-24. EASE through near-home banking:

46. Banking Outlets within 5

km of every village as approved

by State Level Bankers’ Committees

47. Most branch-based

services through Bank Mitras for branchless banking

48. Mobile ATM in every under-served district by the district lead bank, with pre-announced

programme of availability to customers at various locations

AP-25. Social security

through microinsurance:

49. Massive expansion in

microinsurance coverage by tagging with MSME, agricultural and other retail loan disbursements to

cover borrowing individuals & employees of borrowing entities, under

Pradhan Mantri Suraksha Bima Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana

AP-26. EASE through digital

payments:

50. RuPay debit card issuance

to all Pradhan Mantri Jan Dhan Yojana accountholders

51. Aadhaar-seed all

operative current & savings accounts, as per Prevention of Money-Laundering Rules

52. Enable Aadhaar-seeding

through OTP on mobile

53. Massive expansion in

Aadhaar-enabled payment Points of Sale through BHIM-Aadhaar devices, as per bank-wise target for

deployment of 20 lakh devices

AP-27. Customer protection

against cyber-frauds:

54. Ensure credit-back

against unauthorised debit in electronic transaction, within 10 working days, of notification

by customer, as per mandated norms

55. Real-time alerts for

customer protection through data

analytics, process automation and intelligent monitoring

56. Free customer-level

security updates for apps and Internet-based utilities

Developing Personnel for

Brand PSBs

AP-28. Reward select top-performers

identified

through a Performance Management System (PMS):

57. Performance Management System (PMS) based policy for rewarding select top-performers,

approved by the Board, covering:

(a) classification of roles as measurable

and non-measurable;

(b) objective grading framework that

distinguishes top performers; and

(c) incentive & fast-track promotion

for the top performers.

58. Incorporate with PMS, end-to-end digitised Annual Appraisal

Reports of all staff,

covering both filing and assessment, beginning with the performance appraisal

for 2018-19

AP-29. Specialisation through job families—Appropriately identify and

59. optimally allocate personnel to enable:

(a) identification of roles for each job

family;

(b)

obtaining of options; and

(c)

optimal allocation of personnel to job families through an objective process

AP-30. Mandate annual role-based e-learning

programme for all officers and a fellowship & training programme for senior

executives :

60. (a) Assign weightage in appraisal for

e-learning programme

(b)

Develop e-learning role-based lessons with randomised, variable question bank

for evaluation, and lay down minimum number of online lessons to be

successfully completed annually

(c) Assign weightage for exit evaluation in

appraisal for fellowship &

training programme

Report Card promised on Public Sector Bank Reforms Agenda

was released by Finance Minister Late Shri Arun Jaitley on 28th

February 2019

Key Highlights:

- Independent EASE Report validates 4R strategy & confirms banking turnaround;

- EASE Index measures & benchmarks reform progress of each PSB on 140 metrics;

- Team PSB delivers on Reform Agenda across all six themes: 15% rise in 3 quarters;

- Big strides in Clean Banking — 26% rise in Responsible Banking EASE Index score

Subsequent to the announcement of EASE Reforms Agenda, BCG

was onboarded through IBA to design methodology for objectively measuring

performance of each PSB on the Reforms Agenda. A steering committee

comprising select WTDs of PSBs, under the aegis of Indian Banks’

Association (IBA), has monitored the design and implementation of EASE

Reforms Index.

The independent report was commissioned through Indian Banks’ Association

and authored by BCG with Forrester Inc., Kantar IMRB and TransUnion CIBIL as

knowledge partners. The report confirmed the effectiveness of Government’s

4R’s strategy in securing banking turnaround, with large 26% Index gain

in Responsible Banking underpinning clean banking, and measurable progress in

all six Enhance Access & Service Excellence (EASE) reform themes over the

three quarters ending December 2018.

The Index measures performance of each PSB on 140

objective metrics across 6 themes and provides all PSBs a comparative evaluation showing

where banks stand vis-à-vis benchmarks and peers on the Reforms Agenda. The

Index follows a fully transparent scoring methodology, which

enables banks to identify precisely their strengths as well as areas for

improvement.

The report validates government’s 4R’s strategy and its

role in fundamentally rebooting Public Sector Banks. The index and report

unveiled today provides insights into how public sector banks are effectively

addressing NPA problem. The report shows visible progress made on each of 4

elements of Government’s 4R’s strategy including recognition,

recovery, recapitalisation and reforms.

EASE report shows significant improvement in PSB

performance on the back of Government’s 4R’s strategy –

- Stress recognition almost complete: Standard restructured advances as a

percentage of gross advances reduced from 7% in Mar-15 to 0.5% in Dec-18

- GNPA trend reversed: GNPA reduced by Rs 31,168 crore, GNPA

ratio have started declining after peaking in Mar-18 and has declined for

three successive quarters post Mar-18.

- Record recovery: IBC has led to record recovery- Rs 98,493

crore recovered by PSBs in first nine months of FY19, YOY growth of 103%.

- PSB balance-sheet

strengthened: PSB balance sheets

strengthened through infusion of Rs 3.19 lakh crore including infusion by

Government and market raising. This has helped five banks to come out of

PCA restrictions and improve PCR from 46% in FY15 to 69% in Dec-18 leading

to reduced risk.

- Stress indicators

improving: Fresh slippages

reduced by Rs 58,000 crore in first nine months of FY19 compared to same

period previous FY, Stock of overdue account reduced by 47%, credit risk

weighted assets to gross advances reduced by 11%.

Reforms: Multiple reforms

implemented covering wider financial system and PSBs.

CLEAN Banking

EASE index tracks multiple

steps are taken by PSBs to institutionalise CLEAN banking and avoid recurrence

of NPA problem in future. This includes limiting consortiums to smaller

efficient groups, special agencies for monitoring large loans, rationalisation

of unviable overseas operations, strong risk appetite framework, focus on

strong credit appraisals.

Smart Banking

PSB Reforms EASE Agenda lays

strong emphasis on speedy and responsive customer service with an objective to

drive SMART Banking. EASE Index shows that PSBs are significantly driving SMART

Banking and initial results of the reforms are visible

SMART Banking leading to usage

of triangulated data and risk minimisation

Diligence across data sources,

process digitilisation and analytics enabling robust underwriting, Fraud risk

mitigation, Credit process compliance, and importantly customer ease.

PCA banks show 30% improvement

in responsible banking theme of EASE Index

Underlying causes of weakness

in PCA banks getting substantially addressed

- 6 banks without Stressed

Asset Verticals fully operationalised SAMV

- Recovery of Rs 35,405

crore in three qrtrs (72% YoY growth)

- Corporate exposure

reduced from 49% in Mar-18 to 40% in Dec-18 as per focus segment strategy

EASE Index: Sustainable Reform ingrained in PSBs

The Index provides all PSBs a comparative evaluation

showing where banks stand vis-à-vis benchmarks and peers on the Reforms Agenda.

The Index follows a fully transparent scoring methodology, which enables banks to

identify precisely their strengths as well as areas for improvement. Through

periodic updates and by providing bank-specific scorecards and inter-bank

comparisons, all PSBs are enabled to keep track of their progress on key reform

priorities across time. The goal is to continue driving change by spurring

healthy competition among PSBs and also by encouraging them to learn from each

other.

The number of initiatives under progress in each PSB

concern different departments and are at different levels of progress. EASE

Reforms Index provides a robust framework to track the progress of reforms not

only across the PSBs but also within the PSBs. The methodology of EASE Reforms

Index is shared transparently with PSBs. They can leverage the same and can

create customised index for tracking reforms based on bank’s priorities, set up

centralised teams to comprehensively drive EASE Reforms Agenda and link performance

metrics of concerned employees to achievement on metrics covered in EASE

Reforms Index. With this, the EASE Reforms will get ingrained further and will

catalyse PSB performance on multiple dimensions.

Performance of PSB on EASE

Index

PSBs have shown strong trajectory in their performance

over 3 quarters post the launch of EASE Reforms Agenda. Overall score of PSBs

increased by 15% between Mar-18 and Dec-18 with average score of PSBs improving

from 56.3 to 64.5. Significant progress is seen across themes, with highest

growth being in Responsible banking.

Some of the key areas with strong progress across themes

are:

§

Responsible

Banking: PSBs strengthened large credit appraisal, monitoring, recovery

processes and improved their risk management and capital management practices.

- Developing personnel for

brand PSB: PSBs initiated roll out of Job-families, deployed online

learning platforms, increased measurability in appraisals, etc.

- Deepening FI and

digitalization: PSBs ensured Bank Mitras remain active, widened their

bouquet of services, focused on improving adoption digital transactions,

improved Aadhaar / mobile seeding

- Credit off-take and PSB as UdyamiMitra for

MSMEs: PBSs reduced loan processing time in retail, focused on revival of

stressed MSMEs, drove adoption of TReDS, and deployed dedicated marketing

teams & relationship managers, etc.

- Customer responsiveness:

PSBs focused on improving customer satisfaction, identifying and reducing

complaints in top-5 complaint categories, reducing complaint resolution

time.

(Source: Press Information Bureau, Government of

India, Ministry of Finance dt 28-February-2019)

EASE

2.0 scheme: Comprehensive public sector bank reform on the cards

A host of measures are on the cards for transformation of public sector banks

(PSBs). While consolidation topped the agenda, a list of directions was

separately worked out for state-owned lenders to focus on risk assessment,

enhanced early warning signals in cases of stressed assets and bringing in new

fintech players.

PSBs have already been asked to carry out an internal assessment for shortlisting ideal candidates for possible mergers or acquisitions. In this direction Mega Merger of 10 Banks into four has already been announced in August 2019 after which the total no. of Public Sector Banks shall come down to 12.

PSBs have already been asked to carry out an internal assessment for shortlisting ideal candidates for possible mergers or acquisitions. In this direction Mega Merger of 10 Banks into four has already been announced in August 2019 after which the total no. of Public Sector Banks shall come down to 12.

The new performance parameters that may be introduced this year through

the EASE programme include more stringent early warning signals (EWS) to tackle

stressed assets, effective coordination in large value loans and bringing in

new financial technology players to deepen financial inclusion and

digitalisation.

Another suggestion is to reconstitute the management committee of the board

which takes decisions on large value loans and have representation from risk management.

Separately, the Banks Board Bureau (BBB) has selected around 80 chief

general managers (CGMs) from all PSBs who will be trained in globally acclaimed

management institutes such as the Kellogg School of Management in the United

States. “This is to create a pipeline for future heads in PSBs and also to

address the knowledge gap in key functioning areas of banks.”

SEVERAL ADMINISTRATIVE REFORMS

ANNOUNCED are:

>> Bank managements made accountable to boards

>> Bank board committees to appraise performance of GM and above, including that of MD

>> Bank boards given the flexibility to introduce CGM level as per business needs

>> Span of control made manageable in large PSBs, post consolidation.

>> Banks will recruit chief risk officers from market to market-linked compensation to attract best talent

>> Boards will decide system of individual development plans for all senior executive positions

>> To ensure sufficient tenure, boards given flexibility to prescribe residual service of 2 years for GM and above

>> Flexibility given to boards of large public sector banks to enhance sitting fees of non-official directors

>> Boards given the mandate to reduce/rationalise board committees for better functioning

>> Risk management committees given the mandate to fix accountability for compliance of risk appetite framework

>> Longer terms given to directors on management committees of boards to enable them to contribute effectively

>> MCB loan sanction thresholds enhanced by 100% to enable focussed attention to higher value loan proposals

>> Non-official director's role made analogous to that of independent director

>> Bank boards given the mandate for training of directors, both for induction and for specialised purposes

>> Bank boards to evaluate non-official directors (NOD) performance annually on peer-review basis

>> Executive directors' strength in larger banks has been raised to four for better functional focus and thrust to technology

>> Creation of leadership pipeline to be facilitated under bank boards' leadership development programme.

>> Bank managements made accountable to boards

>> Bank board committees to appraise performance of GM and above, including that of MD

>> Bank boards given the flexibility to introduce CGM level as per business needs

>> Span of control made manageable in large PSBs, post consolidation.

>> Banks will recruit chief risk officers from market to market-linked compensation to attract best talent

>> Boards will decide system of individual development plans for all senior executive positions

>> To ensure sufficient tenure, boards given flexibility to prescribe residual service of 2 years for GM and above

>> Flexibility given to boards of large public sector banks to enhance sitting fees of non-official directors

>> Boards given the mandate to reduce/rationalise board committees for better functioning

>> Risk management committees given the mandate to fix accountability for compliance of risk appetite framework

>> Longer terms given to directors on management committees of boards to enable them to contribute effectively

>> MCB loan sanction thresholds enhanced by 100% to enable focussed attention to higher value loan proposals

>> Non-official director's role made analogous to that of independent director

>> Bank boards given the mandate for training of directors, both for induction and for specialised purposes

>> Bank boards to evaluate non-official directors (NOD) performance annually on peer-review basis

>> Executive directors' strength in larger banks has been raised to four for better functional focus and thrust to technology

>> Creation of leadership pipeline to be facilitated under bank boards' leadership development programme.

Performance of EASE Reforms (1.0

and 2.0) Journey:-

EASE 2.0 which was built on the foundation laid in EASE

1.0 and furthered the progress on reforms. Reform Action Points in EASE 2.0

aimed at making the reforms journey irreversible, strengthening processes and

systems, and driving outcomes. Public Sector Banks have shown significant

improvement in the Action Points of the EASE Reforms Agenda since its

introduction.

Following the completion of recognition of legacy stress

as NPA, PSBs have returned to profitability with sound financial health and

institutionalised systems to prevent the recurrence of past weaknesses.

Public Sector Banks have shown important enhancement in

the Action Points of the EASE Reforms Agenda since its introduction. The

improved financial condition of PSBs reflects in many parameters such as:

- Gross NPAs

reduced from Rs 8.96 lakh crore (14.6%) in March-2018 to

Rs 7.17 lakh crore (11.3%) in December-2019;

- A sharp

decline in fraud occurrence from 0.65% of advances during

FY10-FY14 to 0.20% in FY18-FY20; due to fraud prevention

reforms and proactive checking of legacy NPA

- Record

recovery of Rs 2.04 lakh crore in FY19-9MFY20 driven by

newly setup dedicated stressed account management verticals in PSBs that

have recovered Rs 1.21 lakh crore in the same period;

- Number of

PSBs under PCA down to four;

- 12 PSBs

reporting profits in 9MFY20;

- CRAR 340

bps above the regulatory minimum; and

- The highest

provision coverage ratio of 77.5% in nearly eight years.

Performance of PSB on EASE 2.0

Index

Like in the previous year, progress made by PSBs was

tracked quarterly through a published EASE Reforms Index leading up to the

annual review. In addition to the inclusion of the EASE Reforms Index in the

evaluation of Whole Time Directors of PSBs, it has now been made part of

the annual appraisal of PSB leadership up to two levels below

the Whole Time Directors.

PSBs have shown a healthy trajectory in their performance

over three quarters since the launch of EASE 2.0 Reforms Agenda. The overall

score of PSBs increased by 35% between March-2019 and December-2019, with the

average EASE index score improving from 49.1 to 66.3 out of 100. Significant

progress is seen across six themes of the Reforms Agenda, with the highest

improvement seen in the themes of ‘Responsible Banking’ and ‘PSBs as

Udyamimitra for MSMEs’.

State Bank of India,

Bank of Baroda and

Oriental Bank of Commerce are

the front-runners for the best performing banks.

The final EASE 2.0 index will

be published after declaration of bank results for the financial year.

Major Reform achievements over

March 2018 to December 2019

- Significant

improvement in customer outreach through dedicated marketing force and

external partnerships. The number of dedicated marketing employees has

increased from 8,920 to 17,617

- Turnaround

time for loans reduced by 67% from the average of nearly 30 days

to nearly 10 days

- 80% of PSB

customers now have access to 35+ services on mobile/

Internet banking, 23 services on call center. The availability of services

has nearly doubled over last 18 months.

- Improvement

in the availability of regional languages in call-centers has

increased four-fold

- Complaint

redressal turnaround time reduced from the average of 9 days to 6

days

- 20 branch-equivalent

services made available by PSBs through Bank Mitras

- For

prudential lending, PSBs are now systematically keeping watch on adherence

to risk-based pricing, and cases with deviation have reduced from 59% to

23%, and have put in place data-driven risk-scoring for

appraisal of high-value loans that factors in group-entities.

- Most PSBs have

deployed IT-based EWS systems leveraging third-party

data, which have enabled early, time-bound action in stressed accounts.

Monitoring has also been strengthened by deploying Agencies for

Specialised Monitoring, and proactively monitoring listed entities based

on published financials. Slippage into NPA has reduced from

3.90 lakh crore in 12-months ending March-18 to 1.88 lakh crore in

12-months ending December-19.

- PSBs have

adopted digital platforms such as online OTS, e-Bक्रय, e-DRT for

expedited recovery. 87% of one-time settlement (OTS) cases are now tracked

through dedicated IT systems.

- PSBs have

adopted new ways of credit. 63% of all PSB inland bills

are now discounted through online TReDS

- 40% YoY growth in the

quarterly value of loans disbursed through psbloansin59minutes.com

(Dec-20)

- The

Government has introduced several governance reforms. The governance

reforms include arm’s length selection of top bank management through

Banks Board Bureau, introduction of non-executive chairpersons, broader talent

pool for such selections, empowered bank Boards, strengthening of

the Board committees system, enhancing the effectiveness of non-official

directors, and leadership development and succession planning for the top

two levels below the Board. In larger PSBs, Executive Director strength

has been increased, and Boards are empowered to introduce CGM level for

increased business.

EASE 3.0

Union Minister for Finance

& Corporate Affairs Smt. Nirmala Sitharaman unveiled EASE

3.0, the Public Sector Bank (PSB) Reforms Agenda 2020-21 for smart,

tech-enabled banking, and the PSB EASE Reforms Annual Report 2019-20 on

February 26, 2020 during an event in New Delhi. The function was organised

by IBA (Indian Banks Association). Minister of State for Finance and Corporate

Affairs Anurag Thakur was the guest of honour for the event. Finance Secretary

Rajiv Kumar, Secretary Designate cum Special Secretary (Financial Services)

Debashish Panda and Chairman IBA, Rajnish Kumar also graced the unveiling

event.

Finance Minister Smt.

Sitharaman exhorted Public Sector Banks (PSBs) to have one-to-one

interface with their customers through branch-based banking and not rely so

much on credit ratings agencies.

She said that banks need

to connect with their customers by leveraging technology but not exclusively

only through the interface of technology. she asked the bankers

to focus more at the grassroot level.

Smt. Sitharaman further

exhorted banks to be friendlier to its customers by using local language

in bank branch. She said that PSBs have played a great role in

enabling financial inclusion in the country.

What is EASE 3.0:

Ease (Enhanced Access and Service

Excellence) 3.0 reform agenda aims at providing smart, tech-enabled public sector

banking for aspiring India.

New features that customers of public sector banks may experience under EASE 3.0 reforms agenda include facilities like:

1. Palm Banking for “End-to-end digital delivery of financial service”.

2. “Banking on Go” via EASE banking outlets at frequently visited spots like malls, stations, complexes, and campuses.

New features that customers of public sector banks may experience under EASE 3.0 reforms agenda include facilities like:

1. Palm Banking for “End-to-end digital delivery of financial service”.

2. “Banking on Go” via EASE banking outlets at frequently visited spots like malls, stations, complexes, and campuses.

The idea

behind EASE 3.0 agenda:

The Ministry has the idea of

establishing paperless and digitally enabled banking at places where people

visit the most. The government aims to focus on digitalization in the Public Sector

Banks (PSBs) among themes that include responsible banking, PSBs as Udyami

Mitra, customer responsiveness, credit take-off, and deep financial inclusions.

EASE 3.0 — Smart, Tech-enabled

Banking for Aspiring India

Over the last five years, PSBs

have not only cleaned up legacy stress and addressed underlying systemic

weaknesses but have emerged stronger as a result of comprehensive and

institutionalized EASE reforms. EASE 3.0 sets the agenda and roadmap for FY21

for their transformation into digital and data-driven NextGen Banking

of the Future for an aspiring India.

With EASE 1.0 and 2.0 laying a

firm foundation of robust banking and institutionalised systems, PSBs are set

to transform into digital- and data-driven NextGen banks. EASE 3.0 emphasizes on

the use of digital, analytics & AI, FinTech partnerships across customer

service, convenient banking, end-to-end digitalised processes for loan sourcing

and processing, analytics-driven risk management as well as decision support

systems for HR.

Key Reform Action Points

in EASE 3.0 include:

- Dial-a-loan: Digitally-enabled doorstep facilitation

for initiation of retail and MSME loans. Customers will have the facility

to register loan requests through digitally-enabled channels

- Customer-need driven credit offers by larger PSBs to

existing customers through analytics, e.g., for EMI on

expenses like holidays/school-fees/jewellery/consumer durables, home loan

takeovers, loan-against-property post home loan closure, working capital

enhancement based on sales jump

- Partnerships with FinTechs and E-commerce

companies for

customer-need driven credit offers

- Credit@click: End-to-end digitalised,

time-bound retail and MSME lending by larger PSBs, leveraging Account

Aggregators, FinTechs and PSBloansin59minutes.com

- Cash-flow-based MSME credit by larger PSBs,

using FinTech, Account Aggregator and other third-party data and

transactions-based underwriting models

- Tech-enabled agriculture lending

- Palm banking: End-to-end digitalised delivery of a full

bouquet of financial services in regional languages and with industry-best

service quality

- EASE Banking Outlets: On-the-spot banking at

frequently visited places such as train stations, bus stands, malls,

hospitals, etc. through paperless and digitally-enabled banking

outlets and kiosks

PSBs have

already started taking steps based on the reforms agenda. During the event,

several digitally enabled banking solutions, such as tablet-banking,

digitally-driven agriculture lending, paperless and digitally-enabled EASE bank

outlets, were demonstrated by the PSBs. Progress of PSBs will continue to be tracked on metrics

linked to Reform Action Points, and their progress will be published through a

quarterly index.

The goal is to continue

driving change by spurring healthy competition among PSBs and also by

encouraging them to learn from each other.

(Source: Press Information Bureau, Government of

India, Ministry of Finance dt. 26-February-2020)